Who do Americans trust with their information?

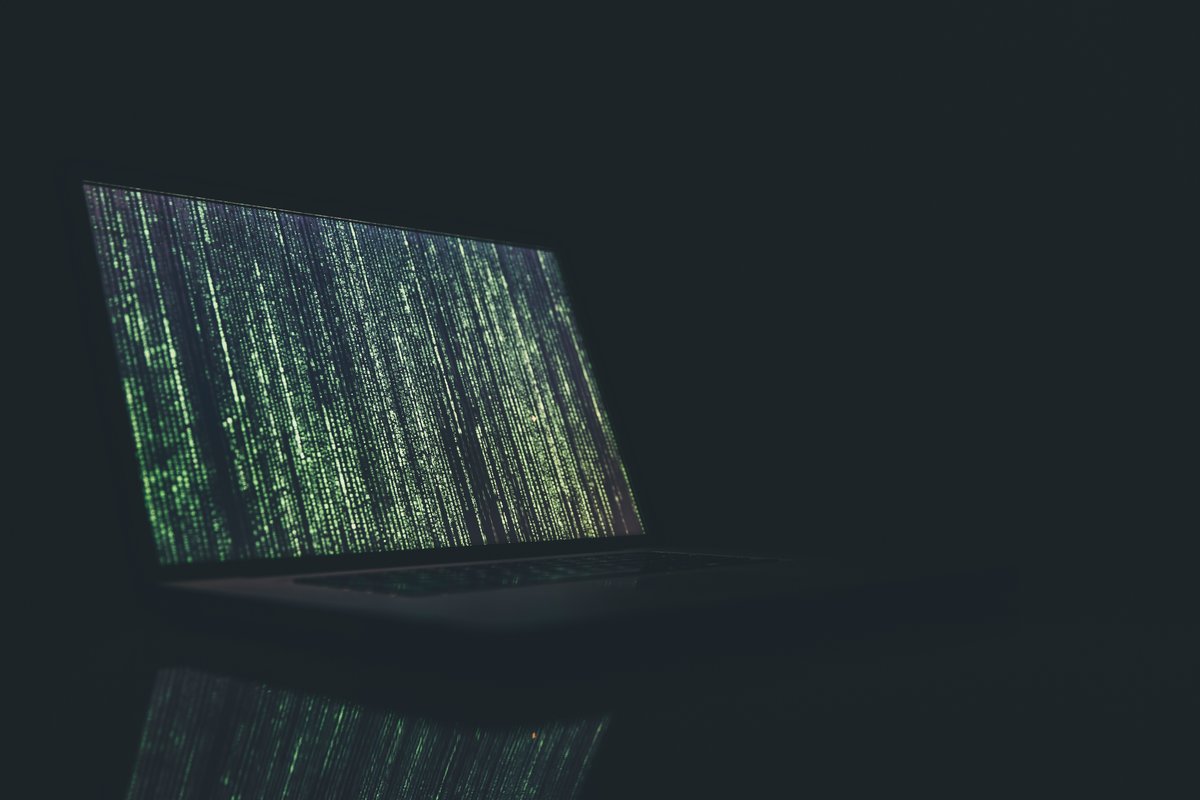

In light of massive data breaches, Americans have doubts about the safety of their personal data. Events like the Facebook Cambridge Analytica hack that affected 87 million Facebook profiles and the Marriott data breach that exposed data of up to 500 million guests are enough to get anyone guessing who they can trust with their sensitive information.

Get the Free Essential Guide to US Data Protection Compliance and Regulations

Consumer mistrust is also prevalent when companies aren’t clear about the data they’re collecting and what they’re doing with it. The Sleep Number controversy is a perfect example of this. Consumers raised concerns after some found a section in their privacy policy that claimed it may record “audio in your room to detect snoring and similar sleep conditions.”

Sleep Number has since confirmed that it was a mistake in their policy and none of their beds have microphones or recording capabilities (the line actually refers to a product prototype that was not launched). To make matters even worse, a reported 91 percent of people tap “I agree” terms and services without reading them and a study in 2014 study found that half of online Americans didn’t know what a privacy policy was.

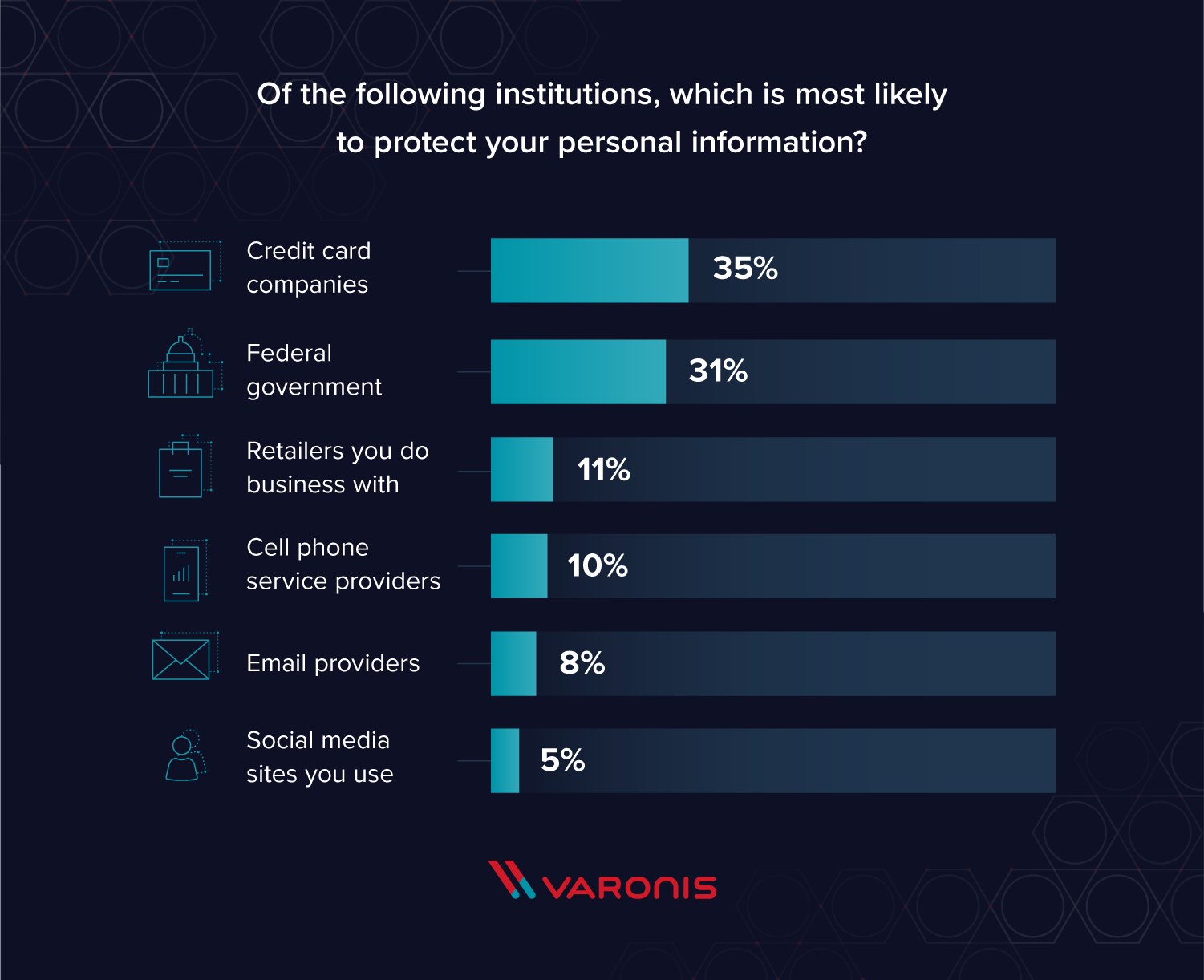

With massive breaches occurring every year and lengthy, hard-to-decipher privacy policies staying unread, the question at hand is, who do Americans trust the most? We surveyed 1,000 people to find out what institution they trust the most with their personal information. Read on to see the results.

More than one-third of Americans trust credit card companies over the government

Specifically, more than one third of Americans trust credit card companies to protect their information more than the federal government. This is surprising, since the infamous Equifax breach in 2017 exposed data from 143 million Americans and compromised 209,000 consumer credit cards. Although Equifax is a credit bureau and not a credit card company, it poses the question: do breaches in related industries affect consumer trust?

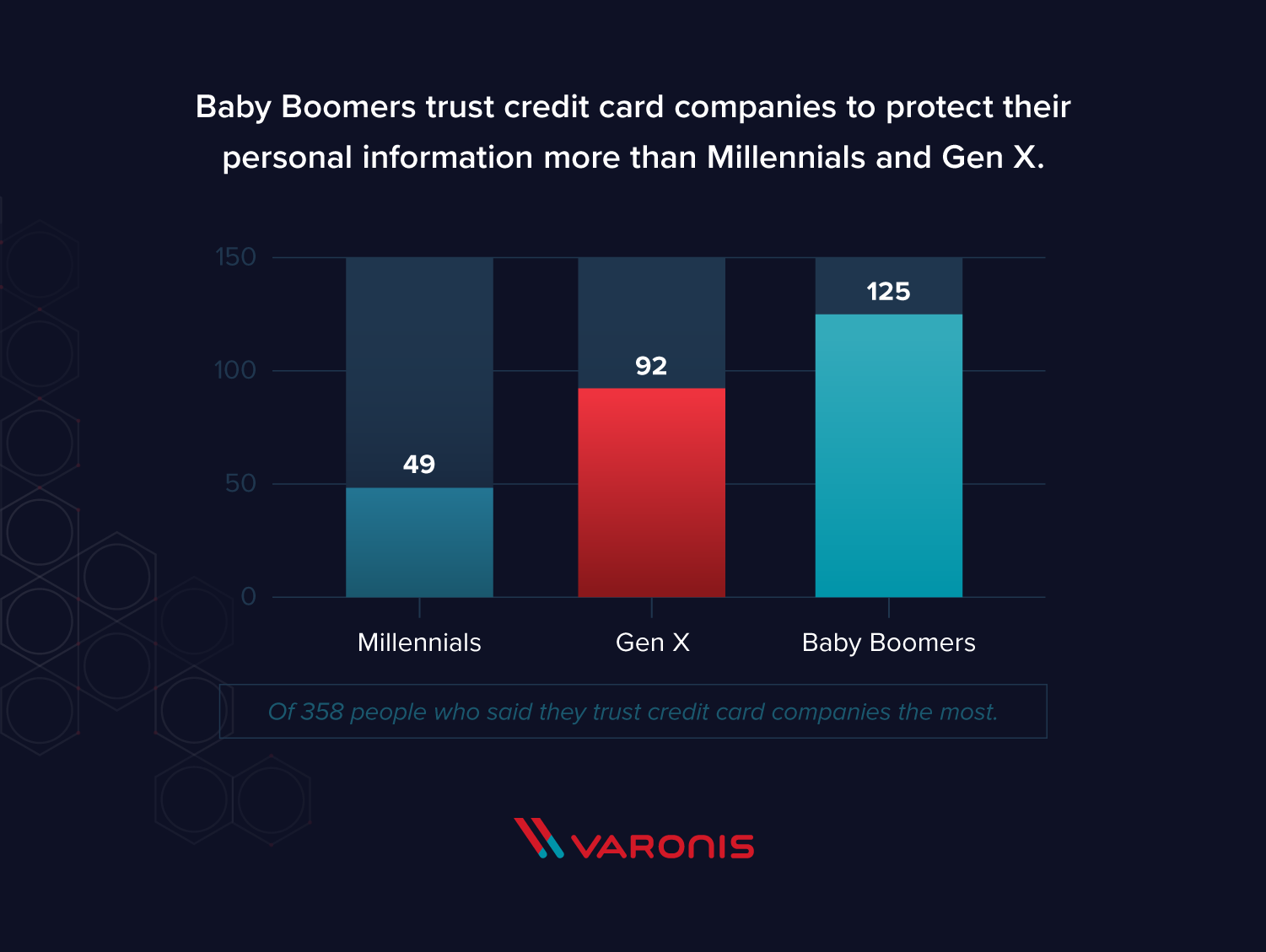

Who trusts credit card companies the most?

Baby Boomers (ages 55+) trust credit card companies significantly more than their Gen X (ages 35 to 54) and Millenial (ages 18 to 34) counterparts because Baby Boomers rely heavily on credit cards and generally have the most positive relationship with them (make payments on time, no debt) in relation to other generations.

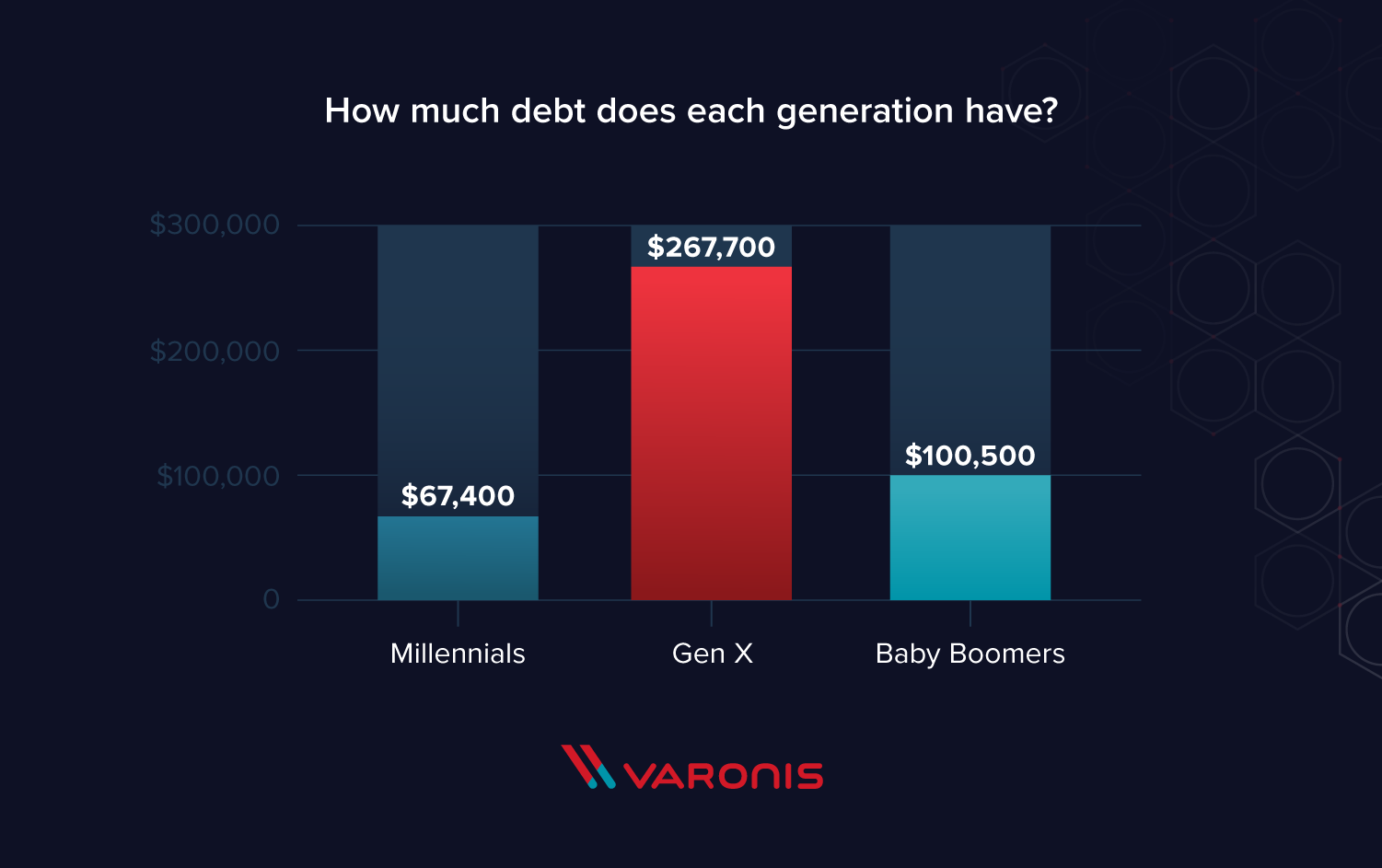

Debt comparison by generation

Source: Money.com

In fact, Baby Boomers use credit cards regularly and are more likely to pay their monthly payments while Gen X, on the other hand, are also heavy credit card users but are more likely to have debt. Finally, millenials are well-known for their aversion to accumulating debt and are most likely to have only one card, if at all. Their dislike for and lack of debt combined with the timing of the Equifax breach early into their adulthood could have been major factors in their low trust level in credit card companies.

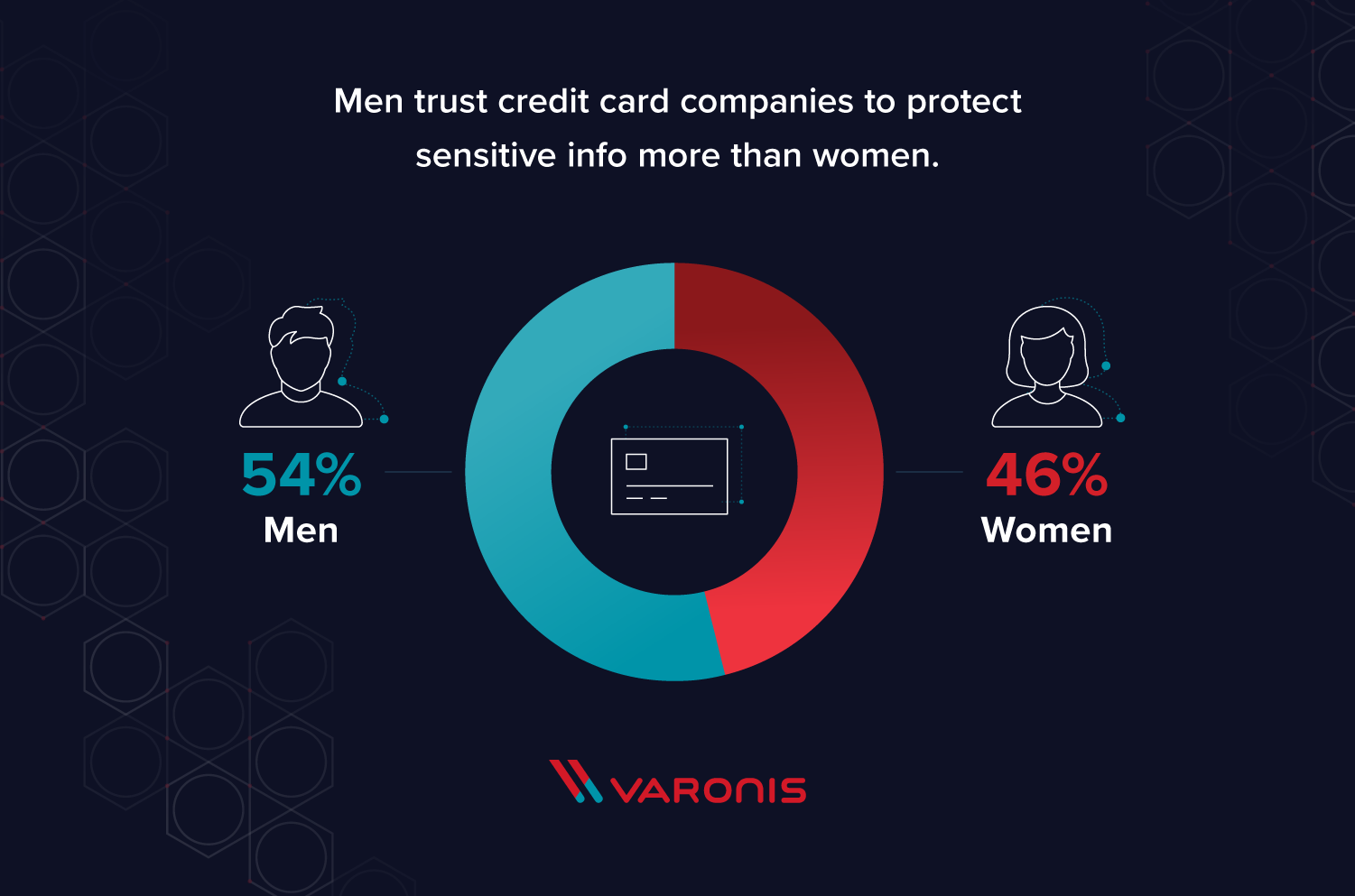

When we look at the difference between gender, we found that men trust credit card companies to protect their personal information slightly more than women. Moreover, we found that men slightly trust all institutions (except retailers) more than women.

Less than one-third of Americans trust the government

On the other hand, less than one-third of Americans said they trusted the federal government more than any other institution with their personal information. A 2015 study conducted by the Pew Research Center found that only 6 percent of adults were “very confident” that government agencies can keep their records private and secure and another 25 percent were “somewhat confident.” We found that Gen X trusted the federal government the most and that men also only slightly trust the federal government more than women.

How to keep your information safe

Regardless of who you trust, it’s important to be your own first line of defense when it comes to protecting your personal data. A few things you can do include creating strong passphrases and making an effort to read privacy policies from beginning to end to see what companies are collecting from you. You should also get familiar with data privacy regulations like the CCPA and GDPR since these are policies that protect personal data and gives consumers the opportunity to opt out of data collection. Browse through our tips below to see what other precautions you can take to protect your data.

Security and privacy settings

- Read through all privacy policies to see what information companies are collecting from you.

- Limit permissions or completely sever relationships with companies that are collecting too much information.

- Employ unique passphrases for all of your accounts and use a password management software to securely keep track of everything.

- Use multi-factor authentication for an extra layer of protection in addition to your password.

Email, social, and mobile

- Refrain from sharing personal information because you never know what people will do with that information.

- Don’t click on links or open emails you’re unsure of. Instead, directly visit or contact the sites attempting to get in touch with you.

- When in doubt, delete and report any suspicious friend requests and messages.

- Don’t use public Wi-Fi when conducting data-sensitive activities like banking. Wait until you can access a secure network.

Device and data safety

- Lock and password-protect your devices and sensitive files.

- Install strong antivirus software on all of your devices including tablets and smartphones.

- Keep all of your software and hardware updated to ensure you’re protected from malware and other potential exploits.

- Backup and encrypt your data on the cloud and other places to protect yourself from ransomware attacks.

Like in any relationship, trust takes a long time to build and seconds to break. Clearer privacy policies, stronger encryptions and better all around cybersecurity practices are a few things companies can proactively do to build up trust in an era filled with high-profile breaches. On the other hand, Americans can take an active approach to their security by taking precautions with their data and holding companies accountable to protect their personal information. Click on the button below to download the full infographic about Americans and their privacy concerns.

Methodology

This trust study was conducted for Varonis using Google Consumer Surveys. The sample consists of 1,000 respondents, with an average margin of error of 5.3 percent. This survey was conducted on January 11, 2019.

What should I do now?

Below are three ways you can continue your journey to reduce data risk at your company:

Schedule a demo with us to see Varonis in action. We'll personalize the session to your org's data security needs and answer any questions.

See a sample of our Data Risk Assessment and learn the risks that could be lingering in your environment. Varonis' DRA is completely free and offers a clear path to automated remediation.

Follow us on LinkedIn, YouTube, and X (Twitter) for bite-sized insights on all things data security, including DSPM, threat detection, AI security, and more.